CRYPTOCURRENCY

Cryptocurrency (atau crypto currency) adalah aset digital yang dirancang

untuk berfungsi sebagai aalat pembayarandi

mana catatan kepemilikan koin individu disimpan dalam digitalbuku besaratau terkomputerisasibasis datamenggunakankriptografi yang kuatuntuk

mengamankan entri catatan transaksi, untuk mengontrol pembuatan catatan koin

digital tambahan, dan untuk memverifikasi transfer kepemilikan koin.[1][2]Biasanya tidak ada dalam bentuk fisik (seperti uang kertas) dan biasanya

tidak dikeluarkan oleh otoritas pusat. Beberapa cryptocurrency digunakankontrol terdesentralisasisebagai lawan terpusatmata uang digitaldanperbankan sentralsistem.[3]Ketika cryptocurrency dicetak atau dibuat sebelum penerbitan atau

diadakan pada pertukaran terpusat, umumnya dianggap terpusat.[4]Ketika diimplementasikan dengan kontrol terdesentralisasi, setiap

cryptocurrency bekerjabuku besar yang didistribusikanteknologi,

biasanya ablockchain, yang berfungsi sebagai basis data transaksi keuangan publik.[5]

Bitcoin, pertama kali dirilis sebagai perangkat lunak sumber terbuka pada tahun

2009, adalah mata uang digital pertama yang terdesentralisasi.[6]Sejak rilis bitcoin, lebih dari 6.000 altcoin (varian alternatif

bitcoin, atau cryptocurrency lainnya) telah dibuat.

Sejarah

Pada tahun 1983, ahli kriptografi Amerika David

Chaummengandung kriptografi anonimuang elektronikdipanggilecash.[7][8]Kemudian, pada 1995, ia menerapkannya melaluiDigicash,[9]bentuk awal pembayaran elektronik kriptografi yang memerlukan perangkat

lunak pengguna untuk menarik catatan dari bank dan menunjuk kunci terenkripsi

tertentu sebelum dapat dikirim ke penerima. Ini memungkinkan mata uang digital

tidak dapat dilacak oleh bank penerbit, pemerintah, atau pihak ketiga mana pun.

Pada tahun 1996, theNSAmenerbitkan sebuah makalah berjudul Cara Membuat Mint: Kriptografi Uang Elektronik

Anonim, menjelaskan sistem Cryptocurrency, pertama menerbitkannya di milis MIT[10]dan kemudian pada tahun 1997, dalam The American Law Review (Vol. 46,

Edisi 4).[11]

Pada tahun 1998,Wei Daimenerbitkan deskripsi "b-money", yang dicirikan sebagai sistem

uang elektronik terdistribusi anonim.[12]Singkatnya setelah itu,Nick Szabodijelaskansedikit emas.[13]Sukabitcoin dan cryptocurrency lain yang akan mengikutinya, bit gold (jangan

dikacaukan dengan pertukaran berbasis emas kemudian, BitGold) digambarkan

sebagai sistem mata uang elektronik yang mengharuskan pengguna untuk

menyelesaikan bukti kerjaberfungsi dengan solusi yang secara kriptografi disatukan dan

diterbitkan.

Cryptocurrency desentralisasi pertama, bitcoin, dibuat pada 2009 oleh

agaknyapengembang samaran Satoshi

Nakamoto. Itu digunakanSHA-256, fungsi hash kriptografis, sebagaibukti

kerjaskema.[14][15]Pada April 2011,Namecoindiciptakan sebagai upaya membentuk desentralisasiDNS, yang akan membuatsensor internetsangat

sulit. Segera setelahnya, pada Oktober 2011,Litecoinsudah diterbitkan. Itu adalah cryptocurrency pertama yang berhasil

digunakanscryptsebagai

fungsi hash bukan SHA-256. Cryptocurrency terkenal lainnya,Peercoinadalah orang pertama yang menggunakan bukti kerja /bukti kepemilikanhibrida.[16]

Pada 6 Agustus 2014, Inggris mengumumkanPerbendaharaantelah ditugaskan untuk melakukan studi cryptocurrency, dan apa perannya,

jika ada, yang dapat mereka mainkan dalam ekonomi Inggris. Studi ini juga

melaporkan apakah regulasi harus dipertimbangkan.[17]

Definisi

formal

1. Sistem tidak memerlukan otoritas pusat, negaranya dikelola melalui

konsensus terdistribusi.

2. Sistem menyimpan ikhtisar unit cryptocurrency dan kepemilikannya.

3. Sistem menentukan apakah unit cryptocurrency baru dapat dibuat. Jika

unit cryptocurrency baru dapat dibuat, sistem mendefinisikan keadaan asal

mereka dan bagaimana menentukan kepemilikan unit baru ini.

5. Sistem ini memungkinkan transaksi dilakukan di mana kepemilikan unit

kriptografi diubah. Pernyataan transaksi hanya dapat dikeluarkan oleh entitas

yang membuktikan kepemilikan saat ini dari unit-unit ini.

6. Jika dua instruksi berbeda untuk mengubah kepemilikan unit kriptografi

yang sama adalahserentakmasuk, sistem melakukan paling banyak salah satunya.

Altcoin

Istilah altcoin memiliki berbagai definisi serupa. Stephanie Yang dariThe Wall Street Journalmendefinisikan

altcoin sebagai "mata uang digital alternatif,"[20]sementara Paul Vigna, juga dari The Wall Street Journal, menggambarkan

altcoin sebagai versi alternatif bitcoin.[21]Aaron Hankins dariMarketWatchmengacu pada cryptocurrency selain bitcoin sebagai altcoin.[22]

Token kripto

SEBUAHblockchainakun dapat menyediakan fungsi selain melakukan pembayaran, misalnya

dalamaplikasi terdesentralisasiataukontrak pintar. Dalam kasus ini, unit atau koin kadang-kadang disebut sebagai token

kripto (atau kripto-kripto).

Arsitektur

Cryptocurrency terdesentralisasi diproduksi oleh seluruh sistem

cryptocurrency secara kolektif, pada tingkat yang ditentukan ketika sistem

dibuat dan yang diketahui publik. Dalam sistem perbankan dan ekonomi terpusat

sepertiSistem cadangan pemerintah pusat,

dewan perusahaan atau pemerintah mengendalikan persediaan mata uang dengan

mencetak unituang kertasatau menuntut penambahan buku besar perbankan digital. Dalam hal mata

uang digital terdesentralisasi, perusahaan atau pemerintah tidak dapat

menghasilkan unit baru, dan sejauh ini tidak memberikan dukungan untuk

perusahaan lain, bank atau entitas perusahaan yang memiliki nilai aset yang

diukur di dalamnya. Sistem teknis yang mendasari di mana cryptocurrency

terdesentralisasi didasarkan dibuat oleh kelompok atau individu yang dikenal

sebagaiSatoshi Nakamoto.[23]

Pada Mei 2018, lebih dari 1.800 spesifikasi mata uang digital tersedia.[24]Dalam sistem cryptocurrency, keamanan, integritas, dan keseimbanganbuku besardikelola oleh komunitas pihak yang saling tidak percaya yang disebutpenambang: yang menggunakan komputer mereka

untuk membantu memvalidasi dan mencatat waktu transaksi, menambahkannya ke buku

besar sesuai dengan skema cap waktu tertentu.[14]

Sebagian besar cryptocurrency dirancang untuk mengurangi produksi mata

uang secara bertahap, membatasi jumlah total mata uang yang akan beredar.[25]Dibandingkan dengan mata uang biasa yang dipegang oleh lembaga keuangan

atau disimpan sebagaitunaidi tangan, cryptocurrency bisa lebih sulit untukkejangoleh penegak hukum.[1]Kesulitan ini berasal dari memanfaatkan teknologi kriptografi.

Blockchain

Validitas setiap koin cryptocurrency disediakan oleh ablockchain. Blockchain adalah daftar yang terus bertambahcatatan, disebut blok, yang dihubungkan dan

diamankan menggunakankriptografi.[23][26]Setiap blok biasanya berisi ahashpointer sebagai tautan ke blok

sebelumnya,[26]Sebuahcap waktudan data transaksi.[27]Secara desain, blockchains secara inheren tahan terhadap modifikasi

data. Itu adalah "terbuka,buku besar yang didistribusikanyang

dapat mencatat transaksi antara dua pihak secara efisien dan dengan cara yang

dapat diverifikasi dan permanen ".[28]Untuk digunakan sebagai buku besar yang didistribusikan, biasanya

blockchain dikelola oleh apeer-to-peerjaringan secara kolektif mengikuti protokol untuk memvalidasi blok baru.

Setelah direkam, data dalam blok apa pun yang diberikan tidak dapat diubah

secara retroaktif tanpa perubahan semua blok berikutnya, yang membutuhkan

kolusi mayoritas jaringan.

Blockchain adalahaman dengan desaindan merupakan contoh dari sistem komputasi terdistribusi dengan tinggiToleransi kesalahan Bizantium.Terdesentralisasi Oleh karena itu konsensus telah dicapai dengan blockchain.[29]Sifat publik dari buku besar blockchain melindungi integritas dari apa

pun yang ditransaksikan karena tidak ada satu entitas pun yang memiliki basis

data. Pekerjaan tambahan yang diperlukan untuk menyelesaikan enkripsi dalam

sistem proof-of-stake memastikan bahwa buku besar publik tidak dimodifikasi

secara acak, sehingga memecahkanpengeluaran gandamasalah

tanpa perlu otoritas atau pusat tepercayaserveruntuk mengelola database, dengan

asumsi tidak51% serangan(yang telah bekerja melawan beberapa cryptocurrency).[kutipan diperlukan]

Timestamping

Cryptocurrency menggunakan berbagai skema timestamping untuk

"membuktikan" validitas transaksi yang ditambahkan ke buku besar

blockchain tanpa perlu pihak ketiga yang tepercaya.

Skema cap waktu pertama yang ditemukan adalah skema proof-of-work. Skema

proof-of-work yang paling banyak digunakan didasarkan pada SHA-256 danscrypt.[16]

Beberapa algoritma hashing lain yang digunakan untuk proof-of-work

termasukCryptoNight,Blake,SHA-3, danX11.

Bukti kepemilikan adalah metode untuk mengamankan jaringan mata uang

kripto dan mencapai konsensus terdistribusi melalui permintaan pengguna untuk

menunjukkan kepemilikan sejumlah mata uang tertentu. Ini berbeda dari sistem

proof-of-work yang menjalankan algoritma hashing yang sulit untuk memvalidasi

transaksi elektronik. Skema ini sangat tergantung pada koin, dan saat ini tidak

ada bentuk standar untuk itu. Beberapa cryptocurrency menggunakan skema proof-of-work

dan proof-of-stake gabungan.[16]

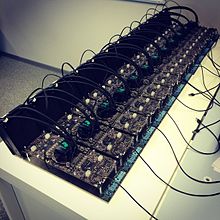

Pertambangan

Dalam jaringan cryptocurrency, penambangan adalah validasi transaksi.

Untuk upaya ini, penambang yang berhasil mendapatkan cryptocurrency baru

sebagai hadiah. Hadiahnya berkurangbiaya transaksidengan menciptakan insentif pelengkap untuk berkontribusi pada kekuatan

pemrosesan jaringan. Tingkat menghasilkan hash, yang memvalidasi transaksi apa

pun, telah meningkat dengan menggunakan mesin khusus sepertiFPGAdanASIC menjalankan algoritma hashing yang kompleks seperti SHA-256 dan Scrypt.[kutipan diperlukan]Perlombaan senjata untuk mesin yang lebih murah namun efisien ini telah

ada sejak hari pertama cryptocurrency, bitcoin, diperkenalkan pada 2009.[kutipan diperlukan]Dengan semakin banyak orang yang terjun ke dunia mata uang virtual,

menghasilkan hash untuk validasi ini menjadi jauh lebih kompleks selama

bertahun-tahun, dengan para penambang harus menginvestasikan sejumlah besar

uang untuk mempekerjakan beberapa ASIC berkinerja tinggi. Dengan demikian nilai

mata uang yang diperoleh untuk menemukan hash sering tidak membenarkan jumlah

uang yang dihabiskan untuk mendirikan mesin, fasilitas pendingin untuk

mengatasi panas yang mereka hasilkan, dan listrik yang dibutuhkan untuk

menjalankannya.[30]Pada Juli 2019, konsumsi listrik bitcoin diperkirakan sekitar 7

gigawatt, 0,2% dari total global, atau setara dengan Swiss.[31]

Beberapasumber daya penambang kolam, berbagikekuatan pemrosesanmelalui

jaringan untuk membagi hadiah secara merata, sesuai dengan jumlah pekerjaan

yang mereka kontribusikan pada kemungkinan menemukan ablok. "Bagian" diberikan kepada

anggota kelompok penambangan yang menunjukkan bukti kerja parsial yang sah.

Pada Februari 2018, Pemerintah Tiongkok menghentikan perdagangan mata

uang virtual, melarang penawaran koin awal dan menghentikan penambangan.

Beberapa penambang Cina sejak itu pindah ke Kanada.[32] Satu perusahaan mengoperasikan pusat data untuk operasi penambangan di

lokasi ladang minyak dan gas Kanada, karena harga gas yang rendah.[33]Pada Juni 2018,Hydro Quebecmengusulkan kepada pemerintah provinsi untuk mengalokasikan 500 MW

kepada perusahaan crypto untuk penambangan.[34]Menurut laporan Februari 2018 dari Fortune,[35]Islandia telah menjadi surga bagi penambang cryptocurrency sebagian

karena listriknya yang murah.

Pada bulan Maret 2018, sebuah kota di Upstate New York memberlakukan

moratorium 18 bulan pada semua penambangan cryptocurrency dalam upaya untuk

melestarikan sumber daya alam dan "karakter dan arah" kota.[36]

Kenaikan harga GPU

Peningkatan penambangan cryptocurrency meningkatkan permintaankartu grafis(GPU) pada 2017.[37] (Kekuatan komputasi GPU membuatnya sangat cocok untuk menghasilkan

hash.) Favorit populer penambang cryptocurrency seperti Nvidia's GTX 1060danGTX 1070kartu grafis, serta GPU AMD RX 570 dan RX 580, berlipat dua atau tiga

kali lipat - atau kehabisan stok.[38]A GTX 1070 Ti yang dirilis dengan harga $ 450 terjual sebanyak $ 1100.

Kartu 6 GB model GTX 1060 populer lainnya dirilis pada MSRP sebesar $ 250,

dijual seharga hampir $ 500. Kartu RX 570 dan RX 580 dariAMDkehabisan stok selama hampir setahun. Penambang secara teratur membeli

seluruh stok GPU baru segera setelah tersedia.[39]

Nvidia telah meminta pengecer untuk melakukan apa yang mereka bisa

ketika menjual GPU ke gamer alih-alih penambang. "Gamer datang pertama

untukNvidia, "kata Boris Böhles, manajer PR untuk Nvidiadi wilayah Jerman.[40]

Dompet

Contoh kertas dompet bitcoin yang dapat dicetak

yang terdiri dari satu alamat bitcoin untuk menerima dan kunci pribadi terkait

untuk pengeluaran

SEBUAHdompet cryptocurrencymenyimpan"kunci" publik dan pribadiatau "alamat" yang dapat digunakan untuk menerima atau

menghabiskan mata uang kripto. Dengan kunci pribadi, dimungkinkan untuk menulis

di buku besar publik, secara efektif menghabiskan mata uang kripto terkait.

Dengan kunci publik, orang lain dapat mengirim mata uang ke dompet.

Anonimitas

Bitcoin adalah nama samaran dan bukan anonim karena cryptocurrency dalam

dompet tidak terikat dengan orang, melainkan dengan satu atau lebih kunci

tertentu (atau "alamat").[41]Dengan demikian, pemilik bitcoin tidak dapat diidentifikasi, tetapi

semua transaksi tersedia untuk umum di blockchain. Masih,pertukaran cryptocurrencysering

kali diharuskan oleh hukum untuk mengumpulkan informasi pribadi penggunanya.[kutipan diperlukan]

Tambahan sepertiZerocoin, Zerocash dan CryptoNotetelah

disarankan, yang akan memungkinkan untuk tambahananonimitasdan sepadan.[42][43]

Kesepadanan

Kebanyakan token cryptocurrency adalah sepadan dan dapat dipertukarkan.

Namun uniktoken non-sepadanjuga

ada. Token semacam itu dapat berfungsi sebagai aset dalam gameCryptoKitties.

Ekonomi

Cryptocurrency digunakan terutama di luar perbankan dan lembaga

pemerintah yang ada dan dipertukarkan melalui Internet.

Cekal hadiah

Mata uang digital cryptocurrency, seperti Bitcoin, menawarkan insentif blokir

imbalan bagi para penambang. Ada keyakinan implisit bahwa apakah penambang

dibayar dengan imbalan blok atau biaya transaksi tidak mempengaruhi keamanan

blockchain, tetapi beberapa penelitian menunjukkan bahwa ini bukan masalahnya.[44]

Hadiah yang dibayarkan kepada penambang meningkatkan pasokan mata uang

kripto. Dengan memastikan bahwa memverifikasi transaksi adalah bisnis yang

mahal, integritas jaringan dapat dipertahankan selama node yang baik hati

mengendalikan mayoritas daya komputasi. Algoritma verifikasi membutuhkan banyak

daya pemrosesan, dan karenanya listrik untuk membuat verifikasi cukup mahal

untuk secara akurat memvalidasi blockchain publik. Tidak hanya para penambang

harus memperhitungkan biaya yang terkait dengan peralatan mahal yang diperlukan

untuk mendapat peluang memecahkan masalah hash, mereka juga harus

mempertimbangkan jumlah daya listrik yang signifikan untuk mencari solusi.

Umumnya, hadiah blok lebih besar daripada biaya listrik dan peralatan, tetapi

ini mungkin tidak selalu demikian.[45]

Nilai saat ini, bukan nilai jangka panjang, dari cryptocurrency

mendukung skema hadiah untuk mendorong para penambang untuk terlibat dalam

kegiatan penambangan yang mahal. Beberapa sumber mengklaim bahwa desain Bitcoin

saat ini sangat tidak efisien, menghasilkan kehilangan kesejahteraan sebesar

1,4% relatif terhadap sistem kas yang efisien. Sumber utama untuk inefisiensi

ini adalah biaya penambangan yang besar, yang diperkirakan mencapai 360 Juta

USD per tahun. Ini berarti pengguna bersedia menerima sistem uang tunai dengan

tingkat inflasi 230% sebelum lebih baik menggunakan Bitcoin sebagai alat

pembayaran. Namun, efisiensi sistem Bitcoin dapat ditingkatkan secara

signifikan dengan mengoptimalkan tingkat pembuatan koin dan meminimalkan biaya

transaksi. Peningkatan potensial lainnya adalah untuk menghilangkan kegiatan

penambangan yang tidak efisien dengan mengubah protokol konsensus sekaligus.[46]

Biaya transaksi

Biaya transaksi untuk mata uang digital tergantung pada mata uangPasokankapasitas jaringan pada saat itu, versuspermintaandari pemegang mata uang untuk transaksi yang lebih cepat.[kutipan diperlukan]Pemegang mata uang dapat memilih biaya transaksi tertentu, sementara

entitas jaringan memproses transaksi dalam urutan harga tertinggi yang ditawarkan

hingga terendah.[kutipan diperlukan]Pertukaran Cryptocurrency dapat menyederhanakan proses bagi pemegang

mata uang dengan menawarkan alternatif prioritas dan dengan demikian menentukan

biaya mana yang kemungkinan akan menyebabkan transaksi diproses dalam waktu

yang diminta.[kutipan diperlukan]

Untuketer, biaya transaksi berbeda berdasarkan

kompleksitas komputasi, penggunaan bandwidth, dan kebutuhan penyimpanan,

sedangkan biaya transaksi bitcoin berbeda berdasarkan ukuran transaksi dan

apakah transaksi tersebut menggunakanSegWit.

Pada bulan September 2018, biaya transaksi rata-rata untuk eter sesuai dengan $

0,017,[47]sedangkan untuk bitcoin berkorespondensi dengan $ 0,55.[48]

Beberapa cryptocurrency tidak memiliki biaya transaksi, dan sebagai

gantinya bergantung pada bukti-sisi-pekerjaan dari sisi klien sebagai prioritas

transaksi dan mekanisme anti-spam.[49][50][51]

Pertukaran

Pertukaran cryptocurrencymemungkinkan

pelanggan untuk berdagang cryptocurrency untuk aset lain, seperti konvensionaluang kertas, atau untuk berdagang di antara berbagai mata uang digital.

Pertukaran atom

Pergantian atom adalah suatu mekanisme di mana satu mata uang kripto

dapat ditukar secara langsung dengan mata uang kripto lainnya, tanpa perlu

pihak ketiga yang tepercaya seperti penukaran.

ATM

Jordan Kelley, pendiriRobocoin, diluncurkan yang pertamaATM bitcoindi Amerika Serikat pada 20 Februari 2014. Kios yang dipasang di Austin,

Texas mirip dengan ATM bank tetapi memiliki pemindai untuk membaca identifikasi

yang dikeluarkan pemerintah seperti SIM atau paspor untuk mengonfirmasi

identitas pengguna.[52]

Penawaran koin awal

Sebuahpenawaran koin awal(ICO)

adalah cara kontroversial untuk mengumpulkan dana untuk usaha cryptocurrency

baru. ICO dapat digunakan oleh startup dengan tujuan menghindari regulasi.

Namun, regulator sekuritas di banyak yurisdiksi, termasuk di AS, dan Kanada

telah mengindikasikan bahwa jika koin atau token adalah "kontrak

investasi" (misalnya, di bawah uji Howey, yaitu, investasi uang dengan

ekspektasi yang wajar atas laba berdasarkan secara signifikan pada upaya

kewirausahaan atau manajerial orang lain), itu adalah keamanan dan tunduk pada

peraturan sekuritas. Dalam kampanye ICO, persentase cryptocurrency (biasanya

dalam bentuk "token") dijual kepada pendukung awal proyek dengan

imbalan tender hukum atau cryptocurrency lainnya, sering bitcoin atau eter.[53][54][55]

BerdasarkanPricewaterhouseCoopers,

empat dari 10 penawaran koin awal yang diusulkan terbesar telah digunakanSwisssebagai basis, di mana mereka sering terdaftar sebagai yayasan nirlaba.

Badan pengatur SwissFINMAmenyatakan bahwa mereka akan mengambil "pendekatan seimbang"

untuk proyek-proyek ICO dan akan memungkinkan "inovator yang sah untuk

menavigasi lanskap peraturan dan karenanya meluncurkan proyek mereka dengan

cara yang konsisten dengan undang-undang nasional yang melindungi investor dan

integritas sistem keuangan." Menanggapi berbagai permintaan oleh

perwakilan industri, kelompok kerja ICO legislatif mulai mengeluarkan pedoman

hukum pada tahun 2018, yang dimaksudkan untuk menghilangkan ketidakpastian dari

penawaran cryptocurrency dan untuk membangun praktik bisnis yang berkelanjutan.[56]

Legalitas

Status hukum cryptocurrency bervariasi secara substansial dari satu negara

ke negara dan masih belum terdefinisi atau berubah di banyak dari mereka.

Sementara beberapa negara secara eksplisit mengizinkan penggunaan dan

perdagangan mereka,[57]yang lain telah melarang atau membatasi itu. MenurutPerpustakaan Kongres,

"larangan mutlak" pada perdagangan atau penggunaan cryptocurrency

berlaku di delapan negara: Aljazair, Bolivia, Mesir, Irak, Maroko, Nepal,

Pakistan, dan Uni Emirat Arab. "Larangan implisit" berlaku di 15

negara lain, termasuk Bahrain, Bangladesh, Cina, Kolombia, Republik Dominika,

Indonesia, Iran, Kuwait, Lesotho, Lithuania, Makau, Oman, Qatar, Arab Saudi,

dan Taiwan.[58]Di Amerika Serikat dan Kanada, regulator sekuritas negara bagian dan

provinsi, dikoordinasikan melaluiAsosiasi Administrator

Sekuritas Amerika Utara,

sedang menyelidiki "penipuan bitcoin" danICOdi 40 yurisdiksi.[59]

Berbagai lembaga pemerintah, departemen, dan pengadilan

mengklasifikasikan bitcoin secara berbeda.Bank Sentral Tiongkokmelarang

penanganan bitcoin oleh lembaga keuangan di IndonesiaCinadi awal 2014.

Di Rusia, meskipun cryptocurrency adalah legal, ilegal untuk benar-benar

membeli barang dengan mata uang apa pun selainRubel Rusia.[60]Regulasi dan larangan yang berlaku untuk bitcoin mungkin meluas ke

sistem cryptocurrency serupa.[61]

Cryptocurrency adalah alat potensial untuk menghindari sanksi ekonomi

misalnya terhadapRusia,Iran, atauVenezuela. Rusia juga diam-diam mendukung Venezuela dengan penciptaanpetro(El Petro), cryptocurrency nasional yang

diprakarsai olehMaduropemerintah untuk memperoleh pendapatan minyak yang berharga dengan

menghindari sanksi AS.[kutipan diperlukan]

Pada bulan Agustus 2018, theBank of Thailandmengumumkan

rencananya untuk membuat cryptocurrency sendiri, Mata Uang Digital Bank Sentral

(CBDC).[62]

Larangan iklan

Iklan Cryptocurrency dilarang untuk sementara waktuFacebook,[63]Google,Indonesia,[64]Bing,[65]Snapchat,LinkedIndanMailChimp.[66]Platform internet CinaBaidu,Tencent, danWeibojuga telah melarang iklan bitcoin. Platform JepangBarisdan platform RusiaYandexmemiliki larangan serupa.[67]

Status pajak AS

Pada 25 Maret 2014, Amerika SerikatLayanan Pendapatan Internal(IRS)

memutuskan bahwa bitcoin akan diperlakukan sebagai properti untuk keperluan

pajak. Ini berarti bitcoin akan dikenakanpajak capital gain.[68]Dalam sebuah makalah yang diterbitkan oleh para peneliti dari Oxford dan

Warwick, ditunjukkan bahwa bitcoin memiliki beberapa karakteristik lebih

seperti pasar logam mulia daripada mata uang tradisional, karenanya sesuai

dengan keputusan IRS bahkan jika didasarkan pada alasan yang berbeda.[69]

Pada Juli 2019, IRS mulai mengirim surat kepada pemilik cryptocurrency

yang memperingatkan mereka untuk mengubah pengembalian mereka dan membayar

pajak.[70]

Kekhawatiran hukum dari ekonomi global

yang tidak diatur

Seiring meningkatnya popularitas dan permintaan mata uang online sejak

dimulainya bitcoin pada tahun 2009,[71]jadi ada kekhawatiran bahwa orang yang tidak diregulasi secara ekonomi

global yang ditawarkan cryptocurrency dapat menjadi ancaman bagi masyarakat.

Kekhawatiran berlimpah bahwa altcoin dapat menjadi alat bagi penjahat web

anonim.[72]

Jaringan Cryptocurrency menampilkan kurangnya peraturan yang telah

dikritik sebagai memungkinkan penjahat yang berusaha menghindari pajak danmencuci uang.

Transaksi yang terjadi melalui penggunaan dan pertukaran altcoin ini

independen dari sistem perbankan formal, dan karenanya dapat membuat

penghindaran pajak lebih mudah bagi individu. Karena memetakan penghasilan kena

pajak didasarkan pada apa yang dilaporkan penerima ke layanan pendapatan,

menjadi sangat sulit untuk memperhitungkan transaksi yang dilakukan menggunakan

cryptocurrency yang ada, suatu mode pertukaran yang rumit dan sulit dilacak.[72]

Sistem anonimitas yang ditawarkan sebagian besar cryptocurrency juga

dapat berfungsi sebagai cara yang lebih sederhana untuk mencuci uang. Daripada

mencuci uang melalui jaringan aktor keuangan dan rekening bank luar negeri yang

rumit, mencuci uang melalui altcoin dapat dicapai melalui transaksi anonim.[72]

Kehilangan, pencurian, dan penipuan

Pada bulan Februari 2014, pertukaran bitcoin terbesar di dunia,Mt. Gox, dideklarasikankebangkrutan. Perusahaan menyatakan bahwa mereka telah kehilangan hampir $ 473 juta

dari bitcoin pelanggan mereka karena pencurian. Ini setara dengan sekitar

750.000 bitcoin, atau sekitar 7% dari semua bitcoin yang ada. Harga bitcoin

turun dari tertinggi sekitar $ 1.160 di bulan Desember menjadi di bawah $ 400

di bulan Februari.[73]

Dua anggota Satgas Silk Road — satgas federal multi-agensi yang

melakukan penyelidikan AS terhadapJalan Sutra- Bitcoin yang disita untuk digunakan

sendiri dalam proses investigasi.[74]Dea agen Carl Mark Force IV, yang berusaha memeras pendiri Silk Road Ross Ulbricht("Dread Pirate Roberts"), mengaku bersalah atas pencucian

uang,halangan keadilan, dan

pemerasan di bawah warna hak resmi, dan dijatuhi hukuman 6,5 tahun penjara

federal.[74]Dinas Rahasia ASagen

Shaun Bridges mengaku bersalah atas kejahatan yang berkaitan dengan pengalihan

bitcoin senilai $ 800.000 ke akun pribadinya selama penyelidikan, dan juga

secara terpisah mengaku bersalah atas pencucian uang sehubungan dengan

pencurian mata uang kripto; dia dijatuhi hukuman hampir delapan tahun di

penjara federal.[75]

Homero Josh Garza, yang mendirikan startup cryptocurrency, GAW Miners

dan ZenMiner pada tahun 2014, diakui dalamperjanjian pembelaanbahwa

perusahaan adalah bagian dari aSkema piramid, dan mengaku bersalahpenipuan kawatpada tahun 2015. ASKomisi Sekuritas dan Bursasecara terpisah membawa tindakan penegakan hukum terhadap Garza, yang

akhirnya diperintahkan untuk membayar $ 9,1 juta ditambah bunga $ 700.000.

Keluhan SEC menyatakan bahwa Garza, melalui perusahaannya, telah secara curang

menjual "kontrak investasi yang mewakili saham dalam keuntungan yang

mereka klaim akan dihasilkan" dari pertambangan.[76]

Pada 21 November 2017, theTether cryptocurrencymengumumkan

mereka diretas, kehilangan $ 31 juta dalam USDT dari dompet utama mereka.[77]Perusahaan telah 'menandai' mata uang yang dicuri, berharap untuk

'mengunci' mereka di dompet peretas (membuatnya tidak bisa dibelanjakan).

Tether menunjukkan bahwa mereka sedang membangun inti baru untuk dompet

utamanya sebagai tanggapan atas serangan untuk mencegah koin curian digunakan.

Pada Mei 2018,Bitcoin Gold(dan dua cryptocurrency lainnya) terkena serangan hashing 51% yang

berhasil oleh aktor yang tidak dikenal, di mana pertukaran kehilangan sekitar $

18 juta.[78]Pada Juni 2018, pertukaran KoreaCoinrail diretas,

kehilangan altcoin senilai US $ 37 juta. Ketakutan seputar peretasan disalahkan

atas penjualan pasar cryptocurrency senilai $ 42 miliar.[79] Pada 9 Juli 2018 pertukaran Bancor memiliki $ 23,5 juta dalam

cryptocurrency dicuri.[80]

Regulator PerancisPemodal Autorite des marchés(AMF)

mencantumkan 15 situs web perusahaan yang mengumpulkan investasi dalam mata

uang digital tanpa diijinkan untuk melakukannya di Prancis.[81]

Pasar Darknet

Properti cryptocurrency memberi mereka popularitas dalam aplikasi

seperti tempat berlindung yang aman dalam krisis perbankan dan alat pembayaran,

yang juga menyebabkan penggunaan cryptocurrency dalam pengaturan kontroversial

dalam bentukpasar gelap online, sepertiJalan Sutra.[72]Jalur Sutra yang asli ditutup pada Oktober 2013 dan ada dua versi lagi

yang digunakan sejak saat itu. Pada tahun setelah penutupan awal Silk Road,

jumlah pasar gelap yang menonjol meningkat dari empat menjadi dua belas,

sementara jumlah daftar obat meningkat dari 18.000 menjadi 32.000.[72]

Pasar Darknet menghadirkan tantangan dalam hal legalitas. Cryptocurrency

yang digunakan di pasar gelap tidak secara jelas atau legal diklasifikasikan di

hampir semua bagian dunia. Di AS, bitcoin diberi label sebagai "aset

virtual".[kutipan diperlukan]Jenis klasifikasi yang ambigu ini memberi tekanan pada lembaga penegak

hukum di seluruh dunia untuk beradaptasi dengan perdagangan obat-obatan

terlarang di pasar gelap.[82][sumber tidak dapat diandalkan?]

Penerimaan

Cryptocurrency telah dibandingkan denganSkema ponzi,skema piramida[83]dangelembung ekonomi,[84]sepertigelembung pasar perumahan.[85]Howard MarksdariManajemen Modal Oaktreemenyatakan

pada 2017 bahwa mata uang digital "hanyalah iseng-iseng tidak berdasar

(atau mungkin bahkan skema piramida), berdasarkan pada kesediaan untuk

menganggap nilai sesuatu yang memiliki sedikit atau tidak ada yang melebihi apa

yang orang akan bayar untuk itu", dan membandingkannya dengantulip mania(1637),Gelembung Laut Selatan(1720), dangelembung dot-com(1999).[86]New Yorkertelah menjelaskan debat berdasarkan wawancara dengan para pendiri

blockchain dalam sebuah artikel tentang "argumen tentang apakah Bitcoin,

Ethereum, dan blockchain mengubah dunia".[87]

Sementara cryptocurrency adalah mata uang digital yang dikelola melalui

teknik enkripsi canggih, banyak pemerintah telah mengambil pendekatan yang

hati-hati terhadap mereka, takut kurangnya kontrol pusat dan efek yang dapat

mereka miliki terhadap keamanan finansial.[88]Regulator di beberapa negara telah memperingatkan terhadap

cryptocurrency dan beberapa telah mengambil langkah-langkah pengaturan konkret

untuk menghalangi pengguna.[89] Selain itu, banyak bank tidak menawarkan layanan untuk cryptocurrency

dan dapat menolak untuk menawarkan layanan kepada perusahaan mata uang virtual.[90]Gareth Murphy, seorang pejabat bank sentral senior telah menyatakan

"penggunaan luas [cryptocurrency] juga akan membuat lebih sulit bagi

lembaga statistik untuk mengumpulkan data kegiatan ekonomi, yang digunakan oleh

pemerintah untuk mengarahkan ekonomi". Dia memperingatkan bahwa mata uang

virtual menimbulkan tantangan baru bagi kendali bank sentral atas fungsi

penting kebijakan moneter dan nilai tukar.[91]Sementara produk keuangan tradisional memiliki perlindungan konsumen

yang kuat di tempat, tidak ada perantara dengan kekuatan untuk membatasi

kerugian konsumen jika bitcoin hilang atau dicuri.[92]Salah satu fitur yang tidak dimiliki cryptocurrency dibandingkan dengan

kartu kredit, misalnya, adalah perlindungan konsumen terhadap penipuan, sepertiserangan balik.

Bitcoin telah dikritik oleh lawan-lawannya karena jumlah energi yang

masuk ke penambangan cryptocurrency bukti-kerjanya; pendukung cryptocurrency

mengklaim bahwa penting untuk membandingkan energi yang dihabiskan dengan

konsumsi sistem keuangan tradisional.[93]

Ada juga elemen teknis murni untuk dipertimbangkan. Misalnya, kemajuan

teknologi dalam cryptocurrency seperti bitcoin menghasilkan biaya di muka yang

tinggi untuk penambang dalam bentuk spesialisasiperangkat kerasdanperangkat lunak.[94]Transaksi Cryptocurrency biasanya tidak dapat dikembalikan setelah

sejumlah blok mengkonfirmasi transaksi. Selain itu, kunci privat cryptocurrency

dapat hilang secara permanen dari penyimpanan lokal karena malware, kehilangan

data, atau kehancuran media fisik. Ini mencegah cryptocurrency dari

dibelanjakan, menghasilkan penghapusan efektif dari pasar.[95]

Komunitas cryptocurrency mengacu pada pra-penambangan, peluncuran

tersembunyi,ICOatau hadiah ekstrem untuk para

pendiri altcoin sebagai praktik menipu.[96]Ini juga dapat digunakan sebagai bagian inheren dari desain

cryptocurrency.[97]Pra-penambangan berarti mata uang dihasilkan oleh pendiri mata uang

sebelum dirilis ke publik.[98]

Paul Krugman, pemenangHadiah Memorial Nobel dalam Ilmu

Ekonomi, telah berulang kali bahwa itu

adalah gelembung yang tidak akan bertahan lama[99]dan menautkannya keTulip mania.[100]Raja bisnis AmerikaWarren Buffettberpikir bahwa cryptocurrency akan berakhir buruk.[101]Pada bulan Oktober 2017,Batu hitamCEOLaurence D. Finkdisebut bitcoin an 'index ofpencucian uang'[102]"Bitcoin hanya menunjukkan berapa banyak permintaan untuk pencucian

uang di dunia," katanya.

Studi akademik

Pada bulan September 2015, pendirianUlasan

rekanjurnal akademisbuku besar(ISSN2379-5980) diumumkan. Ini mencakup studi cryptocurrency dan teknologi terkait,

dan diterbitkan olehUniversitas Pittsburgh.[103]

Jurnal mendorong penulis untuktanda digitalSebuahhash filemakalah yang diajukan, yang kemudian akantimestampedke dalam bitcoinblockchain. Penulis juga diminta untuk

memasukkan alamat bitcoin pribadi di halaman pertama makalah mereka.[104][105]

Lembaga bantuan

SejumlahLembaga bantuansudah mulai menerima donasi dalam cryptocurrency, termasukPalang Merah Amerika,UNICEF[106], danProgram Pangan Dunia PBB.

Cryptocurrency membuat pelacakansumbanganlebih mudah dan memiliki potensi untuk memungkinkan donor melihat

bagaimana uang mereka digunakan (transparansi keuangan).

Christopher Fabian, penasihat utama di UNICEF Innovation mengatakan

bahwa UNICEF akan menjunjung tinggi protokol donor yang ada, yang berarti bahwa

mereka yang melakukan donasi online harus melewati pemeriksaan ketat sebelum

mereka diizinkan untuk menyetor dana ke UNICEF.[107][108]

Cryptocurrency

Bitcoin, first released as open-source software in 2009, is the first decentralized cryptocurrency.[6] Since the release of bitcoin, over 6,000 altcoins (alternative variants of bitcoin, or other cryptocurrencies) have been created.

History

In 1983, the American cryptographer David Chaum conceived an anonymous cryptographic electronic money called ecash.[7][8] Later, in 1995, he implemented it through Digicash,[9] an early form of cryptographic electronic payments which required user software in order to withdraw notes from a bank and designate specific encrypted keys before it can be sent to a recipient. This allowed the digital currency to be untraceable by the issuing bank, the government, or any third party.In 1996, the NSA published a paper entitled How to Make a Mint: the Cryptography of Anonymous Electronic Cash, describing a Cryptocurrency system, first publishing it in an MIT mailing list[10] and later in 1997, in The American Law Review (Vol. 46, Issue 4).[11]

In 1998, Wei Dai published a description of "b-money", characterized as an anonymous, distributed electronic cash system.[12] Shortly thereafter, Nick Szabo described bit gold.[13] Like bitcoin and other cryptocurrencies that would follow it, bit gold (not to be confused with the later gold-based exchange, BitGold) was described as an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published.

The first decentralized cryptocurrency, bitcoin, was created in 2009 by presumably pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, as its proof-of-work scheme.[14][15] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS, which would make internet censorship very difficult. Soon after, in October 2011, Litecoin was released. It was the first successful cryptocurrency to use scrypt as its hash function instead of SHA-256. Another notable cryptocurrency, Peercoin was the first to use a proof-of-work/proof-of-stake hybrid.[16]

On 6 August 2014, the UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to report on whether regulation should be considered.[17]

Formal definition

According to Jan Lansky, a cryptocurrency is a system that meets six conditions:[18]- The system does not require a central authority, its state is maintained through distributed consensus.

- The system keeps an overview of cryptocurrency units and their ownership.

- The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine the ownership of these new units.

- Ownership of cryptocurrency units can be proved exclusively cryptographically.

- The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units.

- If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them.

Altcoin

The term altcoin has various similar definitions. Stephanie Yang of The Wall Street Journal defined altcoins as "alternative digital currencies,"[20] while Paul Vigna, also of The Wall Street Journal, described altcoins as alternative versions of bitcoin.[21] Aaron Hankins of MarketWatch refers to any cryptocurrencies other than bitcoin as altcoins.[22]Crypto token

A blockchain account can provide functions other than making payments, for example in decentralized applications or smart contracts. In this case, the units or coins are sometimes referred to as crypto tokens (or cryptotokens).Architecture

Decentralized cryptocurrency is produced by the entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly known. In centralized banking and economic systems such as the Federal Reserve System, corporate boards or governments control the supply of currency by printing units of fiat money or demanding additions to digital banking ledgers. In the case of decentralized cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which decentralized cryptocurrencies are based was created by the group or individual known as Satoshi Nakamoto.[23]As of May 2018[update], over 1,800 cryptocurrency specifications existed.[24] Within a cryptocurrency system, the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners: who use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme.[14]

Most cryptocurrencies are designed to gradually decrease production of that currency, placing a cap on the total amount of that currency that will ever be in circulation.[25] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[1] This difficulty is derived from leveraging cryptographic technologies.

Blockchain

The validity of each cryptocurrency's coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.[23][26] Each block typically contains a hash pointer as a link to a previous block,[26] a timestamp and transaction data.[27] By design, blockchains are inherently resistant to modification of the data. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way".[28] For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.Blockchains are secure by design and are an example of a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain.[29] The public nature of the blockchain ledger protects the integrity of whatever is being transacted since no one entity owns the database. The added work required to solve the encryption in a proof-of-stake system ensures that the public ledger is not modified at random, thus solving the double-spending problem without the need of a trusted authority or central server to administer the database, assuming no 51% attack (that has worked against several cryptocurrencies).[citation needed]

Timestamping

Cryptocurrencies use various timestamping schemes to "prove" the validity of transactions added to the blockchain ledger without the need for a trusted third party.The first timestamping scheme invented was the proof-of-work scheme. The most widely used proof-of-work schemes are based on SHA-256 and scrypt.[16]

Some other hashing algorithms that are used for proof-of-work include CryptoNight, Blake, SHA-3, and X11.

The proof-of-stake is a method of securing a cryptocurrency network and achieving distributed consensus through requesting users to show ownership of a certain amount of currency. It is different from proof-of-work systems that run difficult hashing algorithms to validate electronic transactions. The scheme is largely dependent on the coin, and there's currently no standard form of it. Some cryptocurrencies use a combined proof-of-work and proof-of-stake scheme.[16]

Mining

Hashcoin mine

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

As of February 2018[update], the Chinese Government halted trading of virtual currency, banned initial coin offerings and shut down mining. Some Chinese miners have since relocated to Canada.[32] One company is operating data centers for mining operations at Canadian oil and gas field sites, due to low gas prices.[33] In June 2018, Hydro Quebec proposed to the provincial government to allocate 500 MW to crypto companies for mining.[34] According to a February 2018 report from Fortune,[35] Iceland has become a haven for cryptocurrency miners in part because of its cheap electricity.

In March 2018, a town in Upstate New York put an 18-month moratorium on all cryptocurrency mining in an effort to preserve natural resources and the "character and direction" of the city.[36]

GPU price rise

An increase in cryptocurrency mining increased the demand for graphics cards (GPU) in 2017.[37] (The computing power of GPUs makes them well-suited to generating hashes.) Popular favorites of cryptocurrency miners such as Nvidia's GTX 1060 and GTX 1070 graphics cards, as well as AMD's RX 570 and RX 580 GPUs, doubled or tripled in price – or were out of stock.[38] A GTX 1070 Ti which was released at a price of $450 sold for as much as $1100. Another popular card GTX 1060's 6 GB model was released at an MSRP of $250, sold for almost $500. RX 570 and RX 580 cards from AMD were out of stock for almost a year. Miners regularly buy up the entire stock of new GPU's as soon as they are available.[39]Nvidia has asked retailers to do what they can when it comes to selling GPUs to gamers instead of miners. "Gamers come first for Nvidia," said Boris Böhles, PR manager for Nvidia in the German region.[40]

Wallets

Anonymity

Bitcoin is pseudonymous rather than anonymous in that the cryptocurrency within a wallet is not tied to people, but rather to one or more specific keys (or "addresses").[41] Thereby, bitcoin owners are not identifiable, but all transactions are publicly available in the blockchain. Still, cryptocurrency exchanges are often required by law to collect the personal information of their users.[citation needed]Additions such as Zerocoin, Zerocash and CryptoNote have been suggested, which would allow for additional anonymity and fungibility.[42][43]

Fungibility

Most cryptocurrency tokens are fungible and interchangeable. However, unique non-fungible tokens also exist. Such tokens can serve as assets in games like CryptoKitties.Economics

Cryptocurrencies are used primarily outside existing banking and governmental institutions and are exchanged over the Internet.Block rewards

Proof-of-work cryptocurrencies, such as Bitcoin, offer block rewards incentives for miners. There has been an implicit belief that whether miners are paid by block rewards or transaction fees does not affect the security of the blockchain, but some studies show that this is not the case.[44]The rewards paid to miners increases the supply of the cryptocurrency. By making sure that verifying transactions is a costly business, the integrity of the network can be preserved as long as benevolent nodes control a majority of computing power. The verification algorithm requires a lot of processing power, and thus electricity in order to make verification costly enough to accurately validate public blockchain. Not only do miners have to factor in the costs associated with expensive equipment necessary to stand a chance of solving a hash problem, they further must consider the significant amount of electrical power in search of the solution. Generally, the block rewards outweigh electricity and equipment costs, but this may not always be the case.[45]

The current value, not the long-term value, of the cryptocurrency supports the reward scheme to incentivize miners to engage in costly mining activities. Some sources claim that the current Bitcoin design is very inefficient, generating a welfare loss of 1.4% relative to an efficient cash system. The main source for this inefficiency is the large mining cost, which is estimated to be 360 Million USD per year. This translates into users being willing to accept a cash system with an inflation rate of 230% before being better off using Bitcoin as a means of payment. However, the efficiency of the Bitcoin system can be significantly improved by optimizing the rate of coin creation and minimizing transaction fees. Another potential improvement is to eliminate inefficient mining activities by changing the consensus protocol altogether.[46]

Transaction fees

Transaction fees for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction.[citation needed] The currency holder can choose a specific transaction fee, while network entities process transactions in order of highest offered fee to lowest.[citation needed] Cryptocurrency exchanges can simplify the process for currency holders by offering priority alternatives and thereby determine which fee will likely cause the transaction to be processed in the requested time.[citation needed]For ether, transaction fees differ by computational complexity, bandwidth use, and storage needs, while bitcoin transaction fees differ by transaction size and whether the transaction uses SegWit. In September 2018, the median transaction fee for ether corresponded to $0.017,[47] while for bitcoin it corresponded to $0.55.[48]

Some cryptocurrencies have no transaction fees, and instead rely on client-side proof-of-work as the transaction prioritization and anti-spam mechanism.[49][50][51]

Exchanges

Cryptocurrency exchanges allow customers to trade cryptocurrencies for other assets, such as conventional fiat money, or to trade between different digital currencies.Atomic swaps

Atomic swaps are a mechanism where one cryptocurrency can be exchanged directly for another cryptocurrency, without the need for a trusted third party such as an exchange.ATMs

Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on 20 February 2014. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[52]Initial coin offerings

An initial coin offering (ICO) is a controversial means of raising funds for a new cryptocurrency venture. An ICO may be used by startups with the intention of avoiding regulation. However, securities regulators in many jurisdictions, including in the U.S., and Canada have indicated that if a coin or token is an "investment contract" (e.g., under the Howey test, i.e., an investment of money with a reasonable expectation of profit based significantly on the entrepreneurial or managerial efforts of others), it is a security and is subject to securities regulation. In an ICO campaign, a percentage of the cryptocurrency (usually in the form of "tokens") is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, often bitcoin or ether.[53][54][55]According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a "balanced approach" to ICO projects and would allow "legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system." In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.[56]

Legality

The legal status of cryptocurrencies varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed their use and trade,[57] others have banned or restricted it. According to the Library of Congress, an "absolute ban" on trading or using cryptocurrencies applies in eight countries: Algeria, Bolivia, Egypt, Iraq, Morocco, Nepal, Pakistan, and the United Arab Emirates. An "implicit ban" applies in another 15 countries, which include Bahrain, Bangladesh, China, Colombia, the Dominican Republic, Indonesia, Iran, Kuwait, Lesotho, Lithuania, Macau, Oman, Qatar, Saudi Arabia and Taiwan.[58] In the United States and Canada, state and provincial securities regulators, coordinated through the North American Securities Administrators Association, are investigating "bitcoin scams" and ICOs in 40 jurisdictions.[59]Various government agencies, departments, and courts have classified bitcoin differently. China Central Bank banned the handling of bitcoins by financial institutions in China in early 2014.

In Russia, though cryptocurrencies are legal, it is illegal to actually purchase goods with any currency other than the Russian ruble.[60] Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems.[61]

Cryptocurrencies are a potential tool to evade economic sanctions for example against Russia, Iran, or Venezuela. Russia also secretly supported Venezuela with the creation of the petro (El Petro), a national cryptocurrency initiated by the Maduro government to obtain valuable oil revenues by circumventing US sanctions.[citation needed]

In August 2018, the Bank of Thailand announced its plans to create its own cryptocurrency, the Central Bank Digital Currency (CBDC).[62]

Advertising bans

Cryptocurrency advertisements were temporarily banned on Facebook,[63] Google, Twitter,[64] Bing,[65] Snapchat, LinkedIn and MailChimp.[66] Chinese internet platforms Baidu, Tencent, and Weibo have also prohibited bitcoin advertisements. The Japanese platform Line and the Russian platform Yandex have similar prohibitions.[67]U.S. tax status

On 25 March 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes. This means bitcoin will be subject to capital gains tax.[68] In a paper published by researchers from Oxford and Warwick, it was shown that bitcoin has some characteristics more like the precious metals market than traditional currencies, hence in agreement with the IRS decision even if based on different reasons.[69]In July 2019, the IRS started sending letters to cryptocurrency owners warning them to amend their returns and pay taxes.[70]

The legal concern of an unregulated global economy

As the popularity of and demand for online currencies has increased since the inception of bitcoin in 2009,[71] so have concerns that such an unregulated person to person global economy that cryptocurrencies offer may become a threat to society. Concerns abound that altcoins may become tools for anonymous web criminals.[72]Cryptocurrency networks display a lack of regulation that has been criticized as enabling criminals who seek to evade taxes and launder money.

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex and difficult to track.[72]

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins can be achieved through anonymous transactions.[72]

Loss, theft, and fraud

In February 2014 the world's largest bitcoin exchange, Mt. Gox, declared bankruptcy. The company stated that it had lost nearly $473 million of their customers' bitcoins likely due to theft. This was equivalent to approximately 750,000 bitcoins, or about 7% of all the bitcoins in existence. The price of a bitcoin fell from a high of about $1,160 in December to under $400 in February.[73]Two members of the Silk Road Task Force—a multi-agency federal task force that carried out the U.S. investigation of Silk Road—seized bitcoins for their own use in the course of the investigation.[74] DEA agent Carl Mark Force IV, who attempted to extort Silk Road founder Ross Ulbricht ("Dread Pirate Roberts"), pleaded guilty to money laundering, obstruction of justice, and extortion under color of official right, and was sentenced to 6.5 years in federal prison.[74] U.S. Secret Service agent Shaun Bridges pleaded guilty to crimes relating to his diversion of $800,000 worth of bitcoins to his personal account during the investigation, and also separately pleaded guilty to money laundering in connection with another cryptocurrency theft; he was sentenced to nearly eight years in federal prison.[75]

Homero Josh Garza, who founded the cryptocurrency startups GAW Miners and ZenMiner in 2014, acknowledged in a plea agreement that the companies were part of a pyramid scheme, and pleaded guilty to wire fraud in 2015. The U.S. Securities and Exchange Commission separately brought a civil enforcement action against Garza, who was eventually ordered to pay a judgment of $9.1 million plus $700,000 in interest. The SEC's complaint stated that Garza, through his companies, had fraudulently sold "investment contracts representing shares in the profits they claimed would be generated" from mining.[76]

On 21 November 2017, the Tether cryptocurrency announced they were hacked, losing $31 million in USDT from their primary wallet.[77] The company has 'tagged' the stolen currency, hoping to 'lock' them in the hacker's wallet (making them unspendable). Tether indicates that it is building a new core for its primary wallet in response to the attack in order to prevent the stolen coins from being used.

In May 2018, Bitcoin Gold (and two other cryptocurrencies) were hit by a successful 51% hashing attack by an unknown actor, in which exchanges lost estimated $18m.[78] In June 2018, Korean exchange Coinrail was hacked, losing US$37 million worth of altcoin. Fear surrounding the hack was blamed for a $42 billion cryptocurrency market selloff.[79] On 9 July 2018 the exchange Bancor had $23.5 million in cryptocurrency stolen.[80]

The French regulator Autorité des marchés financiers (AMF) lists 15 websites of companies that solicit investment in cryptocurrency without being authorised to do so in France.[81]

Darknet markets

Properties of cryptocurrencies gave them popularity in applications such as a safe haven in banking crises and means of payment, which also led to the cryptocurrency use in controversial settings in the form of online black markets, such as Silk Road.[72] The original Silk Road was shut down in October 2013 and there have been two more versions in use since then. In the year following the initial shutdown of Silk Road, the number of prominent dark markets increased from four to twelve, while the amount of drug listings increased from 18,000 to 32,000.[72]Darknet markets present challenges in regard to legality. Cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the U.S., bitcoins are labelled as "virtual assets".[citation needed] This type of ambiguous classification puts pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.[82][unreliable source?]

Reception

Cryptocurrencies have been compared to Ponzi schemes, pyramid schemes[83] and economic bubbles,[84] such as housing market bubbles.[85] Howard Marks of Oaktree Capital Management stated in 2017 that digital currencies were "nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it", and compared them to the tulip mania (1637), South Sea Bubble (1720), and dot-com bubble (1999).[86] The New Yorker has explained the debate based on interviews with blockchain founders in an article about the “argument over whether Bitcoin, Ethereum, and the blockchain are transforming the world”.[87]While cryptocurrencies are digital currencies that are managed through advanced encryption techniques, many governments have taken a cautious approach toward them, fearing their lack of central control and the effects they could have on financial security.[88] Regulators in several countries have warned against cryptocurrency and some have taken concrete regulatory measures to dissuade users.[89] Additionally, many banks do not offer services for cryptocurrencies and can refuse to offer services to virtual-currency companies.[90] Gareth Murphy, a senior central banking officer has stated "widespread use [of cryptocurrency] would also make it more difficult for statistical agencies to gather data on economic activity, which are used by governments to steer the economy". He cautioned that virtual currencies pose a new challenge to central banks' control over the important functions of monetary and exchange rate policy.[91] While traditional financial products have strong consumer protections in place, there is no intermediary with the power to limit consumer losses if bitcoins are lost or stolen.[92] One of the features cryptocurrency lacks in comparison to credit cards, for example, is consumer protection against fraud, such as chargebacks.

Bitcoin has been criticized by its opponents for the amount of energy that goes into its proof-of-work cryptocurrency mining; cryptocurrency proponents claim it is important to compare the energy spent to the consumption of the traditional financial system.[93]

There are also purely technical elements to consider. For example, technological advancement in cryptocurrencies such as bitcoin result in high up-front costs to miners in the form of specialized hardware and software.[94] Cryptocurrency transactions are normally irreversible after a number of blocks confirm the transaction. Additionally, cryptocurrency private keys can be permanently lost from local storage due to malware, data loss or the destruction of the physical media. This prevents the cryptocurrency from being spent, resulting in its effective removal from the markets.[95]

The cryptocurrency community refers to pre-mining, hidden launches, ICO or extreme rewards for the altcoin founders as a deceptive practice.[96] It can also be used as an inherent part of a cryptocurrency's design.[97] Pre-mining means currency is generated by the currency's founders prior to being released to the public.[98]

Paul Krugman, winner of the Nobel Memorial Prize in Economic Sciences, has repeated numerous times that it is a bubble that will not last[99] and links it to Tulip mania.[100] American business magnate Warren Buffett thinks that cryptocurrency will come to a bad ending.[101] In October 2017, BlackRock CEO Laurence D. Fink called bitcoin an 'index of money laundering'.[102] "Bitcoin just shows you how much demand for money laundering there is in the world," he said.

Academic studies

In September 2015, the establishment of the peer-reviewed academic journal Ledger (ISSN 2379-5980) was announced. It covers studies of cryptocurrencies and related technologies, and is published by the University of Pittsburgh.[103]The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain. Authors are also asked to include a personal bitcoin address in the first page of their papers.[104][105]

Aid agencies

A number of aid agencies have started accepting donations in cryptocurrencies, including the American Red Cross, UNICEF[106] , and the UN World Food Program.Cryptocurrencies make tracking donations easier and have the potential to allow donors to see how their money is used (financial transparency).

Christopher Fabian, principal adviser at UNICEF Innovation said that UNICEF would uphold existing donor protocols, meaning that those making donations online would have to pass rigorous checks before they were allowed to deposit funds to UNICEF.[107][108]

See also

- 2018 crypto crash

- Crypto-anarchism

- Cryptocurrency bubble

- Cryptocurrency exchange

- Cryptographic protocol

- List of cryptocurrencies

- Virtual currency law in the United States

References

- ^ a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Retrieved 3 May 2016.

- ^ Allison, Ian (8 September 2015). "If Banks Want Benefits of Blockchains, They Must Go Permissionless". International Business Times. Archived from the original on 12 September 2015. Retrieved 15 September 2015.

- ^ "Centralized Cryptocurrency Exchanges, Explained". COINTELEGRAPH. 10 March 2018. Retrieved 28 April 2020.

- ^ Matteo D'Agnolo. "All you need to know about Bitcoin". timesofindia-economictimes. Archived from the original on 26 October 2015.

- ^ Sagona-Stophel, Katherine. "Bitcoin 101 white paper" (PDF). Archived from the original (PDF) on 13 August 2016. Retrieved 11 July 2016.

- ^ "Archived copy" (PDF). Archived (PDF) from the original on 18 December 2014. Retrieved 26 October 2014.CS1 maint: archived copy as title (link)

- ^ "Archived copy" (PDF). Archived (PDF) from the original on 3 September 2011. Retrieved 10 October 2012.CS1 maint: archived copy as title (link)

- ^ Pitta, Julie. "Requiem for a Bright Idea". Archived from the original on 30 August 2017. Retrieved 11 January 2018.

- ^ "How To Make A Mint: The Cryptography of Anonymous Electronic Cash". groups.csail.mit.edu. Archived from the original on 26 October 2017. Retrieved 11 January 2018.

- ^ Laurie, Law; Susan, Sabett; Jerry, Solinas (11 January 1997). "How to Make a Mint: The Cryptography of Anonymous Electronic Cash". American University Law Review. 46 (4). Archived from the original on 12 January 2018. Retrieved 11 January 2018.

- ^ Wei Dai (1998). "B-Money". Archived from the original on 4 October 2011.

- ^ "Bitcoin: The Cryptoanarchists' Answer to Cash". IEEE Spectrum. Archived from the original on 4 June 2012.

Around the same time, Nick Szabo, a computer scientist who now blogs about law and the history of money, was one of the first to imagine a new digital currency from the ground up. Although many consider his scheme, which he calls "bit gold", to be a precursor to Bitcoin

- ^ a b Jerry Brito and Andrea Castillo (2013). "Bitcoin: A Primer for Policymakers" (PDF). Mercatus Center. George Mason University. Archived (PDF) from the original on 21 September 2013. Retrieved 22 October 2013.

- ^ Bitcoin developer chats about regulation, open source, and the elusive Satoshi Nakamoto Archived 3 October 2014 at the Wayback Machine, PCWorld, 26 May 2013

- ^ a b c Wary of Bitcoin? A guide to some other cryptocurrencies Archived 16 January 2014 at the Wayback Machine, ars technica, 26 May 2013

- ^ "UK launches initiative to explore potential of virtual currencies". The UK News. Archived from the original on 10 November 2014. Retrieved 8 August 2014.

- ^ Lansky, Jan (January 2018). "Possible State Approaches to Cryptocurrencies". Journal of Systems Integration. 9/1: 19–31. doi:10.20470/jsi.v9i1.335. Archived from the original on 12 February 2018. Retrieved 11 February 2018.

- ^ "The Dictionary Just Got a Whole Lot Bigger". Merriam-Webster. March 2018. Archived from the original on 5 March 2018. Retrieved 5 March 2018.

- ^ Yang, Stephanie (31 January 2018). "Want to Keep Up With Bitcoin Enthusiasts? Learn the Lingo". The Wall Street Journal. Archived from the original on 12 June 2018. Retrieved 8 June 2018.

- ^ Vigna, Paul (19 December 2017). "Which Digital Currency Will Be the Next Bitcoin?". The Wall Street Journal. Archived from the original on 12 June 2018. Retrieved 8 June 2018.

- ^ Hankin, Aaron (4 June 2018). "Bitcoin begins the week with a stumble; SEC announces adviser for digital assets". MarketWatch. Archived from the original on 4 June 2018. Retrieved 6 June 2018.

- ^ a b "Blockchains: The great chain of being sure about things". The Economist. 31 October 2015. Archived from the original on 3 July 2016. Retrieved 18 June 2016.

- ^ Badkar, Mamta (14 May 2018). "Fed's Bullard: Cryptocurrencies creating 'non-uniform' currency in US". Financial Times. Archived from the original on 15 May 2018. Retrieved 14 May 2018.

- ^ "How Cryptocurrencies Could Upend Banks' Monetary Role". Archived 27 September 2013 at the Wayback Machine, American Banker. 26 May 2013

- ^ a b Narayanan, Arvind; Bonneau, Joseph; Felten, Edward; Miller, Andrew; Goldfeder, Steven (2016). Bitcoin and cryptocurrency technologies: a comprehensive introduction. Princeton: Princeton University Press. ISBN 978-0-691-17169-2.

- ^ "Blockchain". Investopedia. Archived from the original on 23 March 2016. Retrieved 19 March 2016.

Based on the Bitcoin protocol, the blockchain database is shared by all nodes participating in a system.

- ^ Iansiti, Marco; Lakhani, Karim R. (January 2017). "The Truth About Blockchain". Harvard Business Review. Harvard University. Archived from the original on 18 January 2017. Retrieved 17 January 2017.

The technology at the heart of bitcoin and other virtual currencies, blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.

- ^ Raval, Siraj (2016). "What Is a Decentralized Application?". Decentralized Applications: Harnessing Bitcoin's Blockchain Technology. O'Reilly Media, Inc. pp. 1–2. ISBN 978-1-4919-2452-5. OCLC 968277125. Retrieved 6 November 2016 – via Google Books.

- ^ Hern, Alex (17 January 2018). "Bitcoin's energy usage is huge – we can't afford to ignore it". The Guardian. Archived from the original on 23 January 2018. Retrieved 23 January 2018.

- ^ Baraniuk, Chris (3 July 2019). "Bitcoin's global energy use 'equals Switzerland'". BBC News. Retrieved 2 February 2020.

- ^ "China's Crypto Crackdown Sends Miners Scurrying to Chilly Canada". Bloomberg L.P. 2 February 2018. Archived from the original on 4 March 2018. Retrieved 3 March 2018.

- ^ "Cryptocurrency mining operation launched by Iron Bridge Resources". World Oil. 26 January 2018. Archived from the original on 30 January 2018.

- ^ "Bitcoin and crypto currencies trending up today - Crypto Currency Daily Roundup June 25 - Market Exclusive". marketexclusive.com. Retrieved 27 June 2018.

- ^ "Iceland Expects to Use More Electricity Mining Bitcoin Than Powering Homes This Year". Fortune. Archived from the original on 20 April 2018. Retrieved 25 March 2018.

- ^ "Bitcoin Mining Banned for First Time in Upstate New York Town". Bloomberg L.P. 16 March 2018. Archived from the original on 20 March 2018. Retrieved 20 March 2018.

- ^ "Bitcoin mania is hurting PC gamers by pushing up GPU prices". Archived from the original on 2 February 2018. Retrieved 2 February 2018.

- ^ "Graphics card shortage leads retailers to take unusual measures". Archived from the original on 2 February 2018. Retrieved 2 February 2018.

- ^ "AMD, Nvidia must do more to stop cryptominers from causing PC gaming card shortages, price gouging". Archived from the original on 2 February 2018. Retrieved 2 February 2018.

- ^ "Nvidia suggests retailers put gamers over cryptocurrency miners in graphics card craze". Archived from the original on 2 February 2018. Retrieved 2 February 2018.

- ^ Lee, Justina (13 September 2018). "Mystery of the $2 Billion Bitcoin Whale That Fueled a Selloff". Bloomberg. Archived from the original on 19 December 2018.

- ^ "What You Need To Know About Zero Knowledge". TechCrunch. Archived from the original on 20 February 2019. Retrieved 19 December 2018.

- ^ Greenberg, Andy (25 January 2017). "Monero, the Drug Dealer's Cryptocurrency of Choice, Is on Fire". Wired. ISSN 1059-1028. Archived from the original on 10 December 2018. Retrieved 19 December 2018.

- ^ "On the Instability of Bitcoin Without the Block Reward" (PDF). Retrieved 5 May 2020.

- ^ "Price Fluctuations and the Use of Bitcoin: An Empirical Inquiry" (PDF). Retrieved 5 May 2020.

- ^ "The Economics of Cryptocurrencies – Bitcoin and Beyond" (PDF). Retrieved 5 May 2020.

- ^ "Archived copy". Archived from the original on 26 October 2018. Retrieved 25 October 2018.CS1 maint: archived copy as title (link)

- ^ "Archived copy". Archived from the original on 19 October 2018. Retrieved 25 October 2018.CS1 maint: archived copy as title (link)

- ^ Scalability of the Bitcoin and Nano protocols: a comparative analysis (PDF), Blekinge Institute of Technology, 2018, retrieved 18 December 2019

- ^ Pervez, Huma; Muneeb, Muhammad; Irfan, Muhammad Usama; Haq, Irfan Ul (19 December 2018), "A Comparative Analysis of DAG-Based Blockchain Architectures", 2018 12th International Conference on Open Source Systems and Technologies (ICOSST), IEEE, pp. 27–34, doi:10.1109/ICOSST.2018.8632193, ISBN 978-1-5386-9564-7

- ^ Bencic, Federico Matteo; Podnar Zarko, Ivana (26 April 2018), "Distributed Ledger Technology: Blockchain Compared to Directed Acyclic Graph", 2018 IEEE 38th International Conference on Distributed Computing Systems (ICDCS), University of Zagreb, pp. 1569–1570, arXiv:1804.10013, doi:10.1109/ICDCS.2018.00171, ISBN 978-1-5386-6871-9

- ^ First U.S. Bitcoin ATMs to open soon in Seattle, Austin Archived 19 October 2015 at the Wayback Machine, Reuters, 18 February 2014

- ^ Commission, Ontario Securities. "CSA Staff Notice 46-307 Cryptocurrency Offerings". Ontario Securities Commission. Archived from the original on 29 September 2017. Retrieved 20 January 2018.

- ^ "SEC Issues Investigative Report Concluding DAO Tokens, a Digital Asset, Were Securities". sec.gov. Archived from the original on 10 October 2017. Retrieved 20 January 2018.

- ^ "Company Halts ICO After SEC Raises Registration Concerns". sec.gov. Archived from the original on 19 January 2018. Retrieved 20 January 2018.

- ^ R Atkins (Feb. 2018). Switzerland sets out guidelines to support initial coin offerings Archived 27 May 2018 at the Wayback Machine. Financial Times. Retrieved 26 May 2018.

- ^ Kharpal, Arjun (12 April 2017). "Bitcoin value rises over $1 billion as Japan, Russia move to legitimize cryptocurrency". CNBC. Archived from the original on 19 March 2018. Retrieved 19 March 2018.

- ^ "Regulation of Cryptocurrency Around the World" (PDF). Library of Congress. The Law Library of Congress, Global Legal Research Center. June 2018. pp. 4–5. Archived (PDF) from the original on 14 August 2018. Retrieved 15 August 2018.

- ^ Fung, Brian (21 May 2018). "State regulators unveil nationwide crackdown on suspicious cryptocurrency investment schemes". The Washington Post. Archived from the original on 27 May 2018. Retrieved 27 May 2018.

- ^ Bitcoin's Legality Around The World Archived 16 September 2017 at the Wayback Machine, Forbes, 31 January 2014

- ^ Tasca, Paolo (7 September 2015). "Digital Currencies: Principles, Trends, Opportunities, and Risks". Social Science Research Network. SSRN 2657598. Cite journal requires

|journal=(help) - ^ Thompson, Luke (24 August 2018). "Bank of Thailand to launch its own crypto-currency". Asia Times. Archived from the original on 27 August 2018. Retrieved 27 August 2018.

- ^ Matsakis, Louise (30 January 2018). "Cryptocurrency scams are just straight-up trolling at this point". Wired. Archived from the original on 1 April 2018. Retrieved 2 April 2018.

- ^ Weinglass, Simona (28 March 2018). "European Union bans binary options, strictly regulates CFDs". The Times of Israel. Archived from the original on 1 April 2018. Retrieved 2 April 2018.

- ^ Alsoszatai-Petheo, Melissa (14 May 2018). "Bing Ads to disallow cryptocurrency advertising". Microsoft. Archived from the original on 17 May 2018. Retrieved 16 May 2018.

- ^ French, Jordan (2 April 2018). "3 Key Factors Behind Bitcoin's Current Slide". theStreet.com. Archived from the original on 3 April 2018. Retrieved 2 April 2018.

- ^ Wilson, Thomas (28 March 2018). "Twitter and LinkedIn ban cryptocurrency adverts – leaving regulators behind". Independent. Reuters. Archived from the original on 4 April 2018. Retrieved 3 April 2018.

- ^ Rushe, Dominic (25 March 2014). "Bitcoin to be treated as property instead of currency by IRS". The Guardian. Archived from the original on 1 June 2016. Retrieved 8 February 2018.

- ^ On the Complexity and Behaviour of Cryptocurrencies Compared to Other Markets, 7 November 2014

- ^ https://www.irs.gov/newsroom/irs-has-begun-sending-letters-to-virtual-currency-owners-advising-them-to-pay-back-taxes-file-amended-returns-part-of-agencys-larger-efforts

- ^ Iwamura, Mitsuru; Kitamura, Yukinobu; Matsumoto, Tsutomu (28 February 2014). "Is Bitcoin the Only Cryptocurrency in the Town? Economics of Cryptocurrency and Friedrich A. Hayek". doi:10.2139/ssrn.2405790. hdl:10086/26493. SSRN 2405790. Cite journal requires

|journal=(help) - ^ a b c d e ALI, S, T; CLARKE, D; MCCORRY, P; Bitcoin: Perils of an Unregulated Global P2P Currency [By S. T Ali, D. Clarke, P. McCorry Newcastle upon Tyne: Newcastle University: Computing Science, 2015. (Newcastle University, Computing Science, Technical Report Series, No. CS-TR-1470)

- ^ Mt. Gox Seeks Bankruptcy After $480 Million Bitcoin Loss Archived 12 January 2015 at the Wayback Machine, Carter Dougherty and Grace Huang, Bloomberg News, 28 February 2014

- ^ a b Sarah Jeong, DEA Agent Who Faked a Murder and Took Bitcoins from Silk Road Explains Himself Archived 29 December 2017 at the Wayback Machine, Motherboard, Vice (25 October 2015).

- ^ Nate Raymond, Ex-agent in Silk Road probe gets more prison time for bitcoin theft Archived 29 December 2017 at the Wayback Machine, Reuters (7 November 2017).

- ^ Cyris Farivar, GAW Miners founder owes nearly $10 million to SEC over Bitcoin fraud Archived 29 December 2017 at the Wayback Machine, Ars Technica (5 October 2017).

- ^ Russell, Jon. "Tether, a startup that works with bitcoin exchanges, claims a hacker stole $31M". TechCrunch. Archived from the original on 21 November 2017. Retrieved 22 November 2017.

- ^ Cimpanu, Catalin (4 September 2018). "Bitcoin Gold delisted from major cryptocurrency exchange after refusing to pay hack damages". ZDNet.

- ^ Eric Lam, Jiyeun Lee, and Jordan Robertson (10 June 2018), Cryptocurrencies Lose $42 Billion After South Korean Bourse Hack, Bloomberg News, archived from the original on 12 June 2018, retrieved 12 June 2018CS1 maint: uses authors parameter (link)

- ^ Roberts, Jeff John (9 July 2018). "Another Crypto Fail: Hackers Steal $23.5 Million from Token Service Bancor". Fortune. Archived from the original on 10 July 2018. Retrieved 10 July 2018.

- ^ "News releases AMF: 2018". The Autorité des marchés financiers (AMF). 15 March 2018. Archived from the original on 11 May 2018. Retrieved 10 May 2018.

- ^ Raeesi, Reza (23 April 2015). "The Silk Road, Bitcoins and the Global Prohibition Regime on the International Trade in Illicit Drugs: Can this Storm Be Weathered?". Glendon Journal of International Studies / Revue d'Études Internationales de Glendon. 8 (1–2). ISSN 2291-3920. Archived from the original on 22 December 2015.

- ^ Polgar, David. "Cryptocurrency is a giant multi-level marketing scheme". Quartz. Quartz Media LLC. Archived from the original on 1 March 2018. Retrieved 2 March 2018.

- ^ Analysis of Cryptocurrency Bubbles Archived 24 January 2018 at the Wayback Machine. Bitcoins and Bank Runs: Analysis of Market Imperfections and Investor Hysterics. Social Science Research Network (SSRN). Retrieved 24 December 2017.

- ^ McCrum, Dan (10 November 2015), "Bitcoin's place in the long history of pyramid schemes", Financial Times, archived from the original on 23 March 2017